Journal Entry For Underapplied Overhead

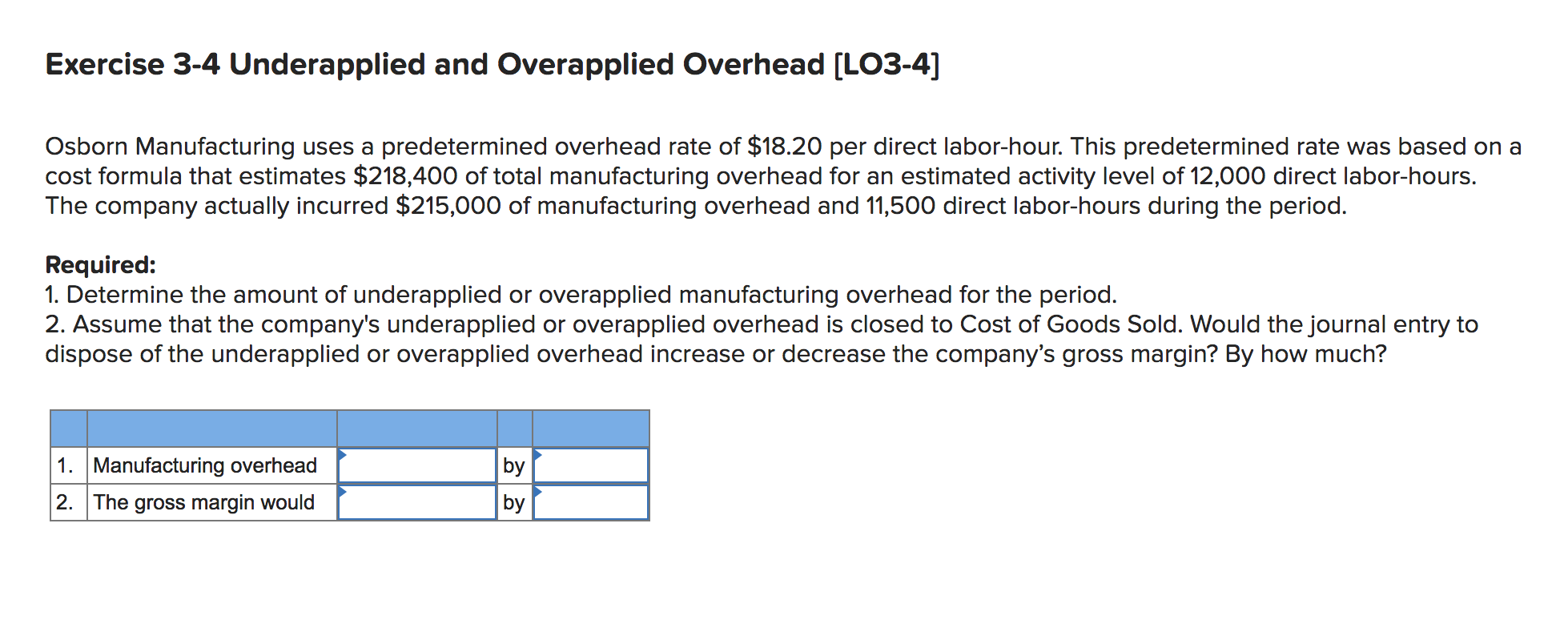

The journal entry for the applied manufacturing overhead cost computed in the above example would be made as follows. If the overhead was overapplied and the actual overhead was 248000 and the applied overhead was 250000 the entry would be.

Sample Assignment On Accounting Question Assignment

135000 --Under-applied over-applied overhead.

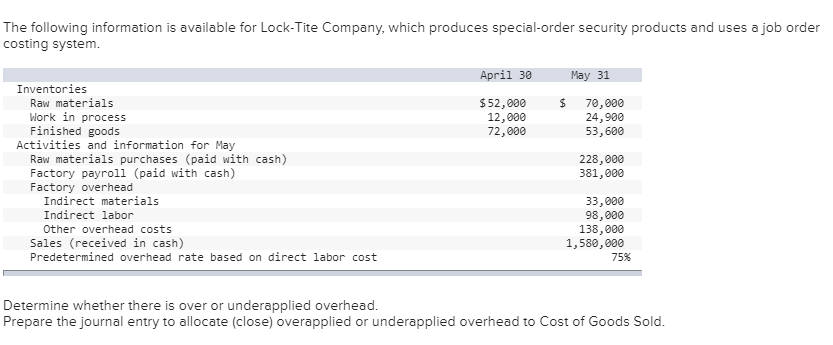

Journal entry for underapplied overhead. If a company has underapplied overhead then the journal entry to dispose of it could possibly include. The entry to correct under-applied overhead using cost of goods sold would be XX represents the amount of under-applied overheard or the. In this case Mind the Cap has underapplied its manufacturing overhead by 25000 250000 - 225000 and an adjustment is required to dispose of the difference.

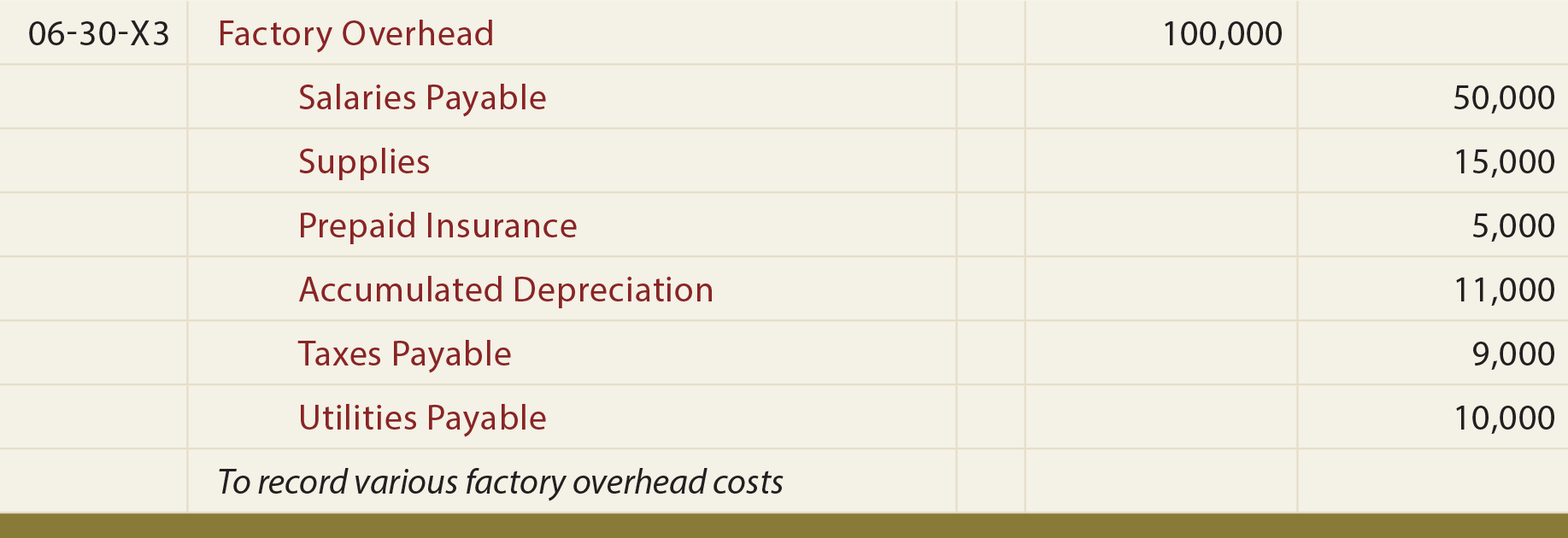

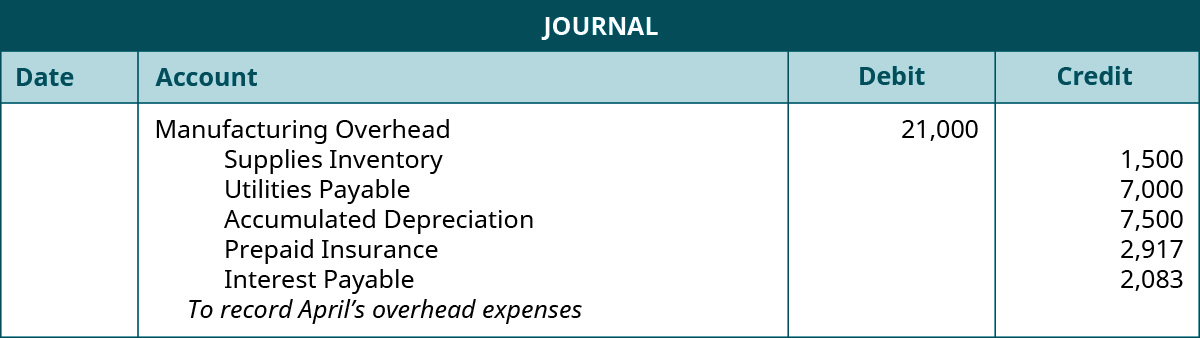

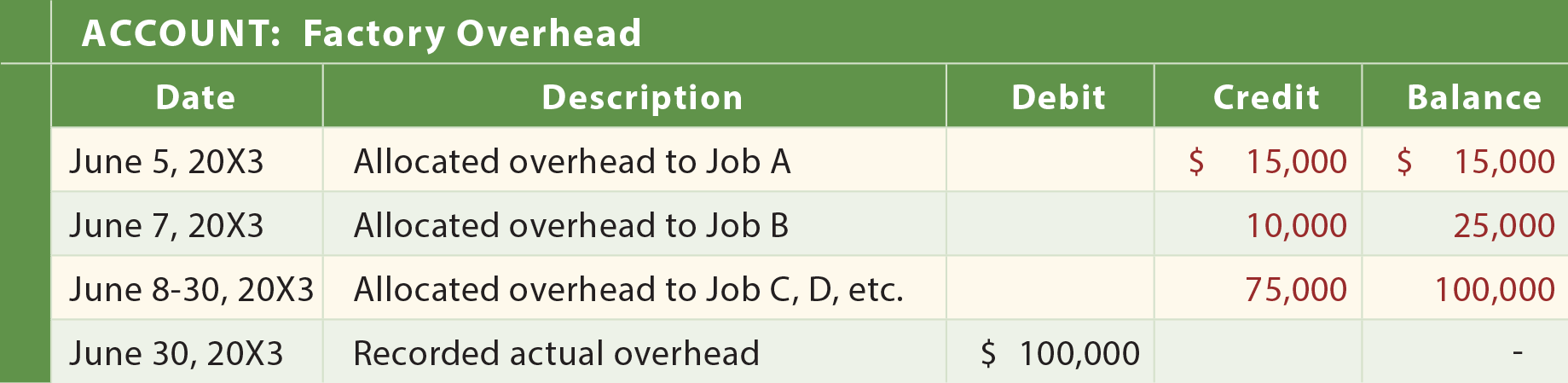

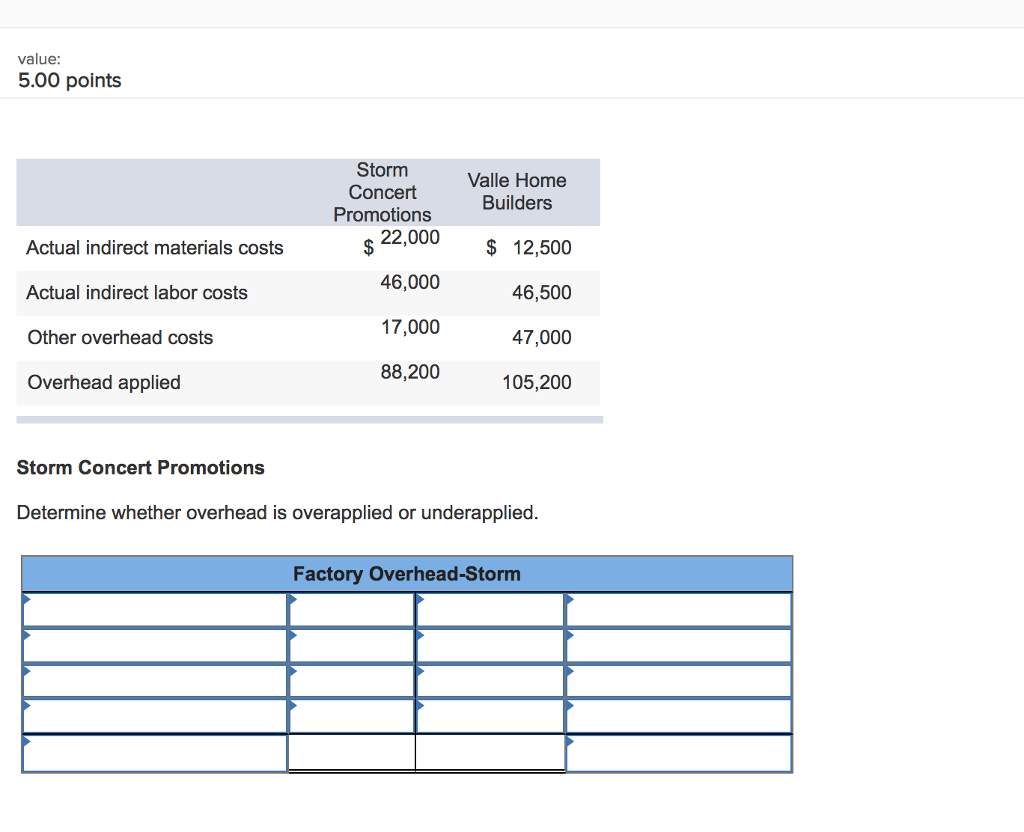

Overhead Absorption General Journal Determine whether there is over or underapplied overhead. What is Underapplied Overhead. Adjust overhead account for over- or underapplied overhead - At the end of the accounting period The journal entry to record depreciation on factory equipment is to.

Credit to Work in Process of 250. Where the overhead is overapplied the following journal entry is made. November after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to.

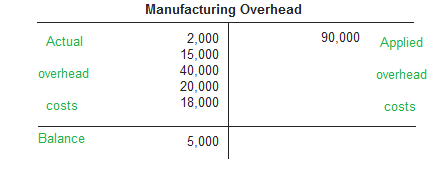

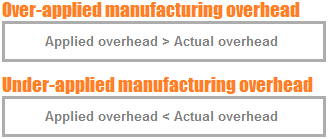

The adjusting journal entry is. After passing one of these journal entries cost of goods sold is adjusted. Since manufacturing overhead has a debit balance it is underapplied as it has not been completely allocated.

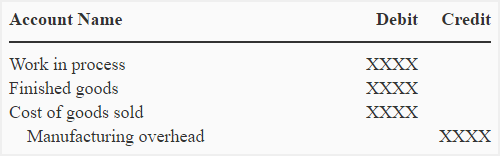

If the applied overhead exceeds the actual amount incurred overhead is said to be overapplied. Manufacturing overhead Cost of goods sold Dr Cr After passing one of these journal entries cost of goods sold is adjusted. If the overhead was overapplied and the actual overhead was 248000 and the applied overhead was 250000 the entry would be.

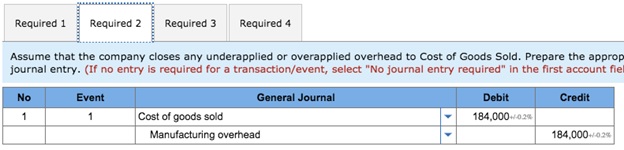

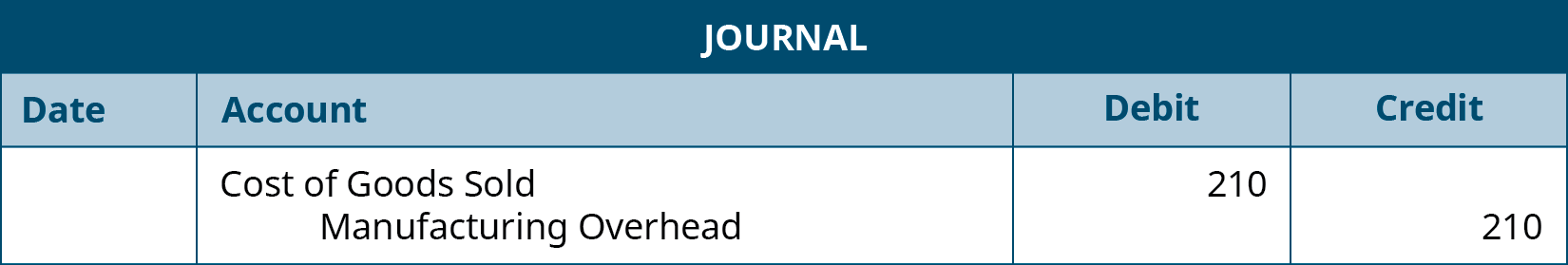

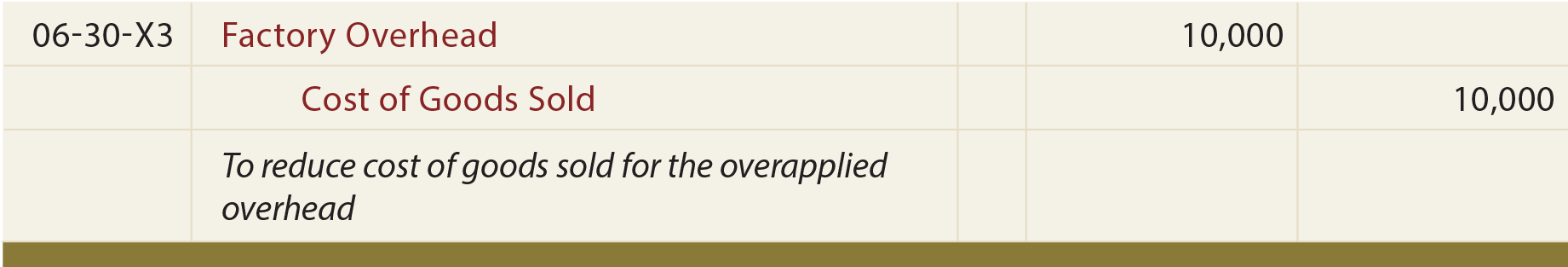

The next journal entry shows the reduction of cost of goods sold to offset the amount of overapplied overhead. Complete this question by entering your answers in the tabs below. Closing out the balance in manufacturing overhead account to cost of goods sold is simpler than the allocation method.

The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for November would include the following. The manufacturing overhead cost applied to the job is debited to work in process account. Underapplied overhead refers to the amount of actual factory overhead costs that are not allocated to units of production.

The adjusting journal entry is. Journal entry to record manufacturing overhead cost. 18000 5000 For company A notice that the amount of overhead cost that has been applied to work in process 272000 is less than the actual overhead cost for the year 290000.

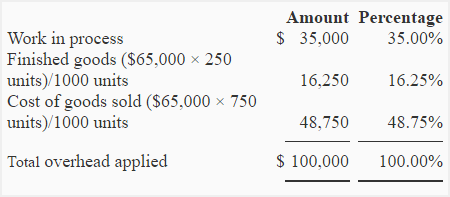

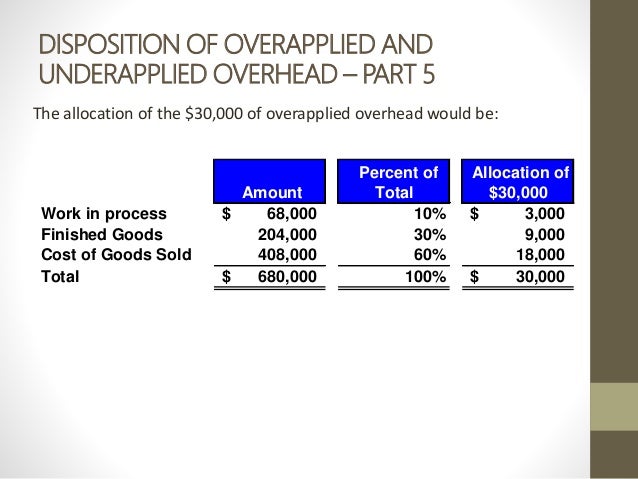

Therefore the overhead is under-applied. To adjust for overapplied or underapplied manufacturing overhead some companies have a more complicated three-part allocation to work in process finished goods and cost of goods sold. The adjusting journal entry is.

If the overhead was overapplied and the actual overhead was 248000 and the applied overhead was 250000 the entry would be. The journal to post the applied overhead is as follows. Prepare the journal entry to allocate close overapplied or underapplied overhead to Cost of Goods Sold.

Credit to Cost of Goods Sold. Journal Entry to Move Work in Process Costs into Finished Goods When each job and job order cost sheet have been completed an entry is made to transfer the total cost from the. A standard allocation is used rather than the actual allocation when management wants to be consistent in applying the same overhead.

Overhead rate Manufacturing overhead Labor hours Overhead rate 324000 36000 900 per labor hour So on a particular job which involved say 100 hours of labor the applied over-head would be 100 x 900 900. Debit Factory Overhead and credit Accumulated Depreciation - Equipment. Consequently cost of goods sold is increased by the amount of underapplied and decreased by the amount of overapplied overhead.

If applied overhead was less than actual overhead we have under-applied overhead or not charged enough cost. The journal entry to record the manufacturing overhead for Job MAC001 is. Consequently cost of goods sold is increased by the amount of underapplied and decreased by the amount of overapplied overhead.

Manufacturing overhead cost applied to work in process during the year. To adjust for overapplied or underapplied manufacturing overhead some companies have a more complicated three-part allocation to work in process finished goods and cost of goods sold. This is usually viewed as a favorable outcome because less has been spent than anticipated for the level of achieved production.

-14 Multiple Choice a credit to Work in Process a credit to Manufacturing Overhead. Rice University Openstax CC BY SA 40. A credit to Finished Goods.

This situation arises when the standard allocation amount per unit of production does not equate to the actual amount of overhead costs incurred in a reporting period.

Determine And Dispose Of Underapplied Or Overapplied Overhead

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Solved Applying Overhead Journal Entries Disposition Of Unde Chegg Com

Solved Exercise 3 8 Applying Overhead Journal Entries D Chegg Com

Solved Determine Whether There Is Over Or Underapplied Ov Chegg Com

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Determine And Dispose Of Underapplied Or Overapplied Overhead Principles Of Accounting Volume 2 Managerial Accounting

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Prepare Journal Entries For A Job Order Cost System Principles Of Accounting Volume 2 Managerial Accounting

Solved Prepare The Adjusting Entry To Allocate Any Over Chegg Com

Answered Exercise 3 4 Underapplied And Bartleby

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Solved 1a Compute The Underapplied Or Overapplied Overhe Chegg Com

Solved 1 Determine Whether Overhead Is Overapplied Or Un Chegg Com

Solved Prepare The Journal Entry To Allocate Close Over Chegg Com

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Comments

Post a Comment